News & Insights

Insights

Insights

Insights

March 18, 2025

Oil in Troubled Waters

Insights

March 10, 2025

Trump 2.0 Reshaping the Mining Industry

Insights

February 24, 2025

Trump's Infrastructure

1

2

3

Insights

October 4, 2024

Environmental, Social, and Governance (ESG) investment has emerged as an important aspect of the financial industry in recent decades. ESG investment, also known as sustainable investing, is the practice of investing in companies that are environmentally responsible, demonstrate excellent corporate citizenship, and are led by accountable management. This ethical investing method helps people connect their financial decisions with their own beliefs. Investors are increasingly using non-financial criteria to detect major risks and growth prospects.

ESG investing involves the consideration of the following aspects:

Many investors are increasingly concerned about social and environmental concerns, including data security and privacy, gender and racial inequality, and the effects of climate change.

ESG investing involves the consideration of the following aspects:

- Environment. What impact does a firm have on the environment? This might include a company's carbon footprint, its avoidance or reduction of harmful chemicals used in manufacturing and other operations, and its pursuit of sustainability across the supply chain.

- Social. How does the organisation increase its social effect, both within and in the broader community?

- Governance. How do the company's board and management promote good change?

Many investors are increasingly concerned about social and environmental concerns, including data security and privacy, gender and racial inequality, and the effects of climate change.

Rather than investing in companies that worsen or contribute to these issues, they prefer to support companies that are at the forefront of ESG activities. According to a 2019 Diligent Institute report, the top quintile (1 out of 5) of S&P 500 companies with the strongest governance performance outperformed the lowest quintile by 15% over a two-year period. Consequently, while formulating their investment plan for their portfolio, investors are adopting an optimistic approach towards investing in companies with a solid ESG foundation and outlook.

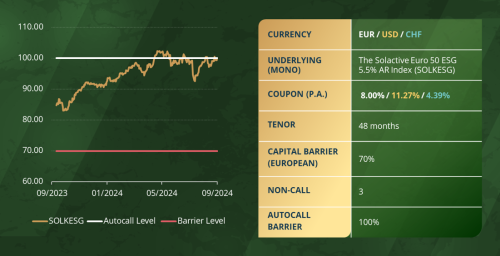

The Solactive Euro 50 ESG 5.5% AR Index (SOLKESG) tracks the price movement of the 50 largest companies within the Eurozone that are also part of the Solactive Europe Corporate Social Responsibility Index. The Solactive Europe Corporate Social Responsibility Index contains 200 shares of European companies that excels in terms of corporate social responsibility (CSR).

Investment Thesis

The Solactive Euro 50 ESG 5.5% AR Index (SOLKESG) tracks the price movement of the 50 largest companies within the Eurozone that are also part of the Solactive Europe Corporate Social Responsibility Index. The Solactive Europe Corporate Social Responsibility Index contains 200 shares of European companies that excels in terms of corporate social responsibility (CSR).

Investment Thesis

- Sustainable Growth: Companies within the Solactive Euro 50 ESG 5.5% AR Index are leaders in their respective industries, with robust ESG practices that position them for sustainable growth. These companies are likely to benefit from the increasing demand for sustainable products and services.

- Regulatory Tailwinds: The European Union’s commitment to achieving net-zero emissions by 2050 and the implementation of stringent ESG regulations provide a favorable environment for companies within this index. These regulatory tailwinds are expected to drive innovation and investment in green technologies, benefiting the constituents of the index.

- Mitigation: Companies with strong ESG profiles tend to exhibit lower risk profiles. They are better equipped to manage regulatory changes, environmental risks, and social issues, which can translate into more stable financial performance.

- Performance Potential: Historical data suggests that ESG-focused indices often outperform their non-ESG counterparts over the long term. The Solactive Euro 50 ESG 5.5% AR Index, with its focus on high-quality, sustainable companies, is well-positioned to deliver competitive returns.

Investing in the Solactive Euro 50 ESG 5.5% AR Index offers a compelling opportunity to gain exposure to leading European companies that are at the forefront of sustainability and responsible business practices. With favorable market conditions, regulatory support, and a growing emphasis on ESG factors, this index is well-positioned to deliver strong performance in 2024. Investors looking for a balanced approach to growth and sustainability should consider this index as a core component of their portfolio.

More details are available in the full Trade Idea

Athena | Product Snapshot

For informational purposes only. Not investment advice.

Insights

October 4, 2024

Zooming in on an ESG Index

Environmental, Social, and Governance (ESG) investment has emerged as an important aspect of the financial industry in recent decades. ESG investment, also known as sustainable investing, is the practice of investing in companies that are environmentally responsible, demonstrate excellent corporate citizenship, and are led by accountable management. This ethical investing method helps people connect their financial decisions with their own beliefs. Investors are increasingly using non-financial criteria to detect major risks and growth prospects.

ESG investing involves the consideration of the following aspects:

Many investors are increasingly concerned about social and environmental concerns, including data security and privacy, gender and racial inequality, and the effects of climate change.

ESG investing involves the consideration of the following aspects:

- Environment. What impact does a firm have on the environment? This might include a company's carbon footprint, its avoidance or reduction of harmful chemicals used in manufacturing and other operations, and its pursuit of sustainability across the supply chain.

- Social. How does the organisation increase its social effect, both within and in the broader community?

- Governance. How do the company's board and management promote good change?

Many investors are increasingly concerned about social and environmental concerns, including data security and privacy, gender and racial inequality, and the effects of climate change.

Rather than investing in companies that worsen or contribute to these issues, they prefer to support companies that are at the forefront of ESG activities. According to a 2019 Diligent Institute report, the top quintile (1 out of 5) of S&P 500 companies with the strongest governance performance outperformed the lowest quintile by 15% over a two-year period. Consequently, while formulating their investment plan for their portfolio, investors are adopting an optimistic approach towards investing in companies with a solid ESG foundation and outlook.

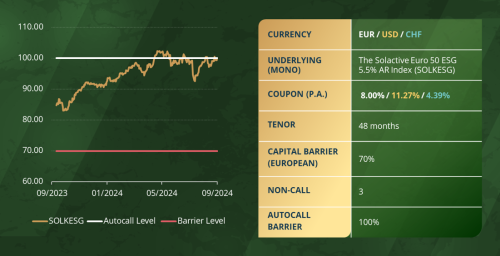

The Solactive Euro 50 ESG 5.5% AR Index (SOLKESG) tracks the price movement of the 50 largest companies within the Eurozone that are also part of the Solactive Europe Corporate Social Responsibility Index. The Solactive Europe Corporate Social Responsibility Index contains 200 shares of European companies that excels in terms of corporate social responsibility (CSR).

Investment Thesis

The Solactive Euro 50 ESG 5.5% AR Index (SOLKESG) tracks the price movement of the 50 largest companies within the Eurozone that are also part of the Solactive Europe Corporate Social Responsibility Index. The Solactive Europe Corporate Social Responsibility Index contains 200 shares of European companies that excels in terms of corporate social responsibility (CSR).

Investment Thesis

- Sustainable Growth: Companies within the Solactive Euro 50 ESG 5.5% AR Index are leaders in their respective industries, with robust ESG practices that position them for sustainable growth. These companies are likely to benefit from the increasing demand for sustainable products and services.

- Regulatory Tailwinds: The European Union’s commitment to achieving net-zero emissions by 2050 and the implementation of stringent ESG regulations provide a favorable environment for companies within this index. These regulatory tailwinds are expected to drive innovation and investment in green technologies, benefiting the constituents of the index.

- Mitigation: Companies with strong ESG profiles tend to exhibit lower risk profiles. They are better equipped to manage regulatory changes, environmental risks, and social issues, which can translate into more stable financial performance.

- Performance Potential: Historical data suggests that ESG-focused indices often outperform their non-ESG counterparts over the long term. The Solactive Euro 50 ESG 5.5% AR Index, with its focus on high-quality, sustainable companies, is well-positioned to deliver competitive returns.

Investing in the Solactive Euro 50 ESG 5.5% AR Index offers a compelling opportunity to gain exposure to leading European companies that are at the forefront of sustainability and responsible business practices. With favorable market conditions, regulatory support, and a growing emphasis on ESG factors, this index is well-positioned to deliver strong performance in 2024. Investors looking for a balanced approach to growth and sustainability should consider this index as a core component of their portfolio.

More details are available in the full Trade Idea

Athena | Product Snapshot

For informational purposes only. Not investment advice.