News & Insights

Insights

Insights

Insights

March 18, 2025

Oil in Troubled Waters

Insights

March 10, 2025

Trump 2.0 Reshaping the Mining Industry

Insights

February 24, 2025

Trump's Infrastructure

1

2

3

Insights

May 28, 2024

Here we embark on the crypto train! In recent times, there has been an upsurge in the number of transactions involving cryptocurrencies all around the world. Due to macro-economic uncertainties, this type of financial asset has become an additional ally when it comes to portfolio diversification for portfolio allocators. The current market pump can be underpinned by the fundamental shifts in the crypto-markets such as a more robust regulatory framework, the absorption of the assets by institutional investors and an ongoing crackdowns on unscrupulous actors contributing to a trustworthy environment for those assets.

Investment in cryptocurrencies can be lucrative due to its high growth potential, hedge against inflation and diversification proponents. In the past decade, there has been a spurt in the growth of the crypto market with some coins registering monumental returns. Due to the scarcity of these assets, investors can also use this as a hedge against inflation. The innovation in technology with the advent of the blockchain has the potential to revolutionise many industries, thereby catalysing the choice of this particular asset class for investors. Security, transparency and decentralisation are the major pillars behind the Blockchain technology. Blockchain generates an immutable record of transactions, making data tampering and fraud virtually impossible. This may be extremely useful in fields such as banking, healthcare, and voting systems. It also enhances traceability in the supply chain by tracking the movement of goods from origin to destination. The process of data and asset management without the dependency on intermediaries such as banks or the government with reduced transaction costs is now a reality with Blockchain technology.

The introduction of Bitcoin ETFs by major financial firms like Fidelity Investments and BlackRock indicated a shift in market sentiment and have attracted new capital into the market. This hike in demand can induce a market rally for this asset class. Morningstar mentions a figure of roughly $7.5 billion worth of Bitcoin specifically flowing into spot Bitcoin ETFs as at the end of February 2024. Furthermore, renowned regulatory bodies such as the European Union's Markets in Crypto-Assets Regulation (MiCA), Financial Stability Board (FSB) and the Financial Action Task Force (FATF) are thoroughly working towards the implementation of comprehensive regulations on cryptocurrencies in view to protect the consumers, curb the occurrence of money laundering and financial stability risk. Regulators are also scrutinising stable coins due to the potential systemic risks. Requirements to comply with a stringent risk management framework, consumer protection measures and adequacy in reserve backing are constantly reviewed during the regulatory process.

Thus, with the recent progress in the blockchain and crypto market, investors are expressing an optimistic investment approach towards stocks that are correlated to the price of cryptocurrency as a result of their involvement with this asset class whilst devising their investment strategy for their portfolio.

The following stocks have been opted to elucidate on this investment idea:

More details are available in the full Trade Idea

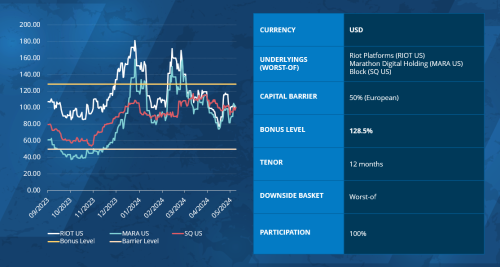

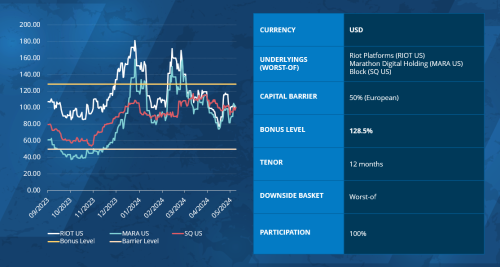

Bonus Certificate | Product Snapshot

For informational purposes only. Not investment advice.

Insights

May 28, 2024

The Revolution of Blockchain and Bitcoin

Here we embark on the crypto train! In recent times, there has been an upsurge in the number of transactions involving cryptocurrencies all around the world. Due to macro-economic uncertainties, this type of financial asset has become an additional ally when it comes to portfolio diversification for portfolio allocators. The current market pump can be underpinned by the fundamental shifts in the crypto-markets such as a more robust regulatory framework, the absorption of the assets by institutional investors and an ongoing crackdowns on unscrupulous actors contributing to a trustworthy environment for those assets.

Investment in cryptocurrencies can be lucrative due to its high growth potential, hedge against inflation and diversification proponents. In the past decade, there has been a spurt in the growth of the crypto market with some coins registering monumental returns. Due to the scarcity of these assets, investors can also use this as a hedge against inflation. The innovation in technology with the advent of the blockchain has the potential to revolutionise many industries, thereby catalysing the choice of this particular asset class for investors. Security, transparency and decentralisation are the major pillars behind the Blockchain technology. Blockchain generates an immutable record of transactions, making data tampering and fraud virtually impossible. This may be extremely useful in fields such as banking, healthcare, and voting systems. It also enhances traceability in the supply chain by tracking the movement of goods from origin to destination. The process of data and asset management without the dependency on intermediaries such as banks or the government with reduced transaction costs is now a reality with Blockchain technology.

The introduction of Bitcoin ETFs by major financial firms like Fidelity Investments and BlackRock indicated a shift in market sentiment and have attracted new capital into the market. This hike in demand can induce a market rally for this asset class. Morningstar mentions a figure of roughly $7.5 billion worth of Bitcoin specifically flowing into spot Bitcoin ETFs as at the end of February 2024. Furthermore, renowned regulatory bodies such as the European Union's Markets in Crypto-Assets Regulation (MiCA), Financial Stability Board (FSB) and the Financial Action Task Force (FATF) are thoroughly working towards the implementation of comprehensive regulations on cryptocurrencies in view to protect the consumers, curb the occurrence of money laundering and financial stability risk. Regulators are also scrutinising stable coins due to the potential systemic risks. Requirements to comply with a stringent risk management framework, consumer protection measures and adequacy in reserve backing are constantly reviewed during the regulatory process.

Thus, with the recent progress in the blockchain and crypto market, investors are expressing an optimistic investment approach towards stocks that are correlated to the price of cryptocurrency as a result of their involvement with this asset class whilst devising their investment strategy for their portfolio.

The following stocks have been opted to elucidate on this investment idea:

More details are available in the full Trade Idea

Bonus Certificate | Product Snapshot

For informational purposes only. Not investment advice.