News & Insights

Insights

Insights

Insights

March 18, 2025

Oil in Troubled Waters

Insights

March 10, 2025

Trump 2.0 Reshaping the Mining Industry

Insights

February 24, 2025

Trump's Infrastructure

1

2

3

Insights

November 7, 2022

The Pharmaceuticals industry is the second-largest industry (in terms of total revenue) in the global Health Care sector. The industry has experienced rapid expansion in recent years, and the outlook continues to be positive for 2023. The industry is expected to exceed $1 trillion by 2023. This is mainly because there are thousands of compounds that are currently in the last phases of clinical development, along with hundreds of new drugs whose approvals are expected in 2023 and later. The pharmaceutical sector has played a crucial role during the pandemic and seems likely to continue beyond 2023. We have seen in recent times about the importance of the pharmaceutical companies as well as the cash they generated. This has definitely bolstered their reputations. Going forward, we use 3 stocks that analysts believe to have a strong perspective outlook: Pfizer Inc, Merck & Co., Inc and Viatris Inc.

Pfizer Inc is one of the world's largest pharmaceutical companies, with extensive operations in drug development, manufacturing, and marketing. Pfizer’s largest market is the U.S., accounting for 37% of 2021 sales, followed by emerging markets at 25%, developed Europe at 23%, and developed Rest of the World at 15%. Pfizer is believed to be among the most diversified drug portfolio in the global drug market. Recently, Pfizer Inc reported strong financial results for second quarter of 2022, with a revenue of $27.7 billion, an increase of 47% as compared to the second quarter of 2021. The company was able to grow its revenue by an outstanding 53% year over year. The quarterly revenue figure represented the largest in Pfizer's history. With the proceeds from the vaccine, the firm is making strategic acquisitions. It has been noted that the $2.26B acquisition of Trillium Therapeutics, a clinical stage immuno-oncology firm developing innovative cancer therapies serving the fast-growing oncology market, as positive. The firm expects to further enhance its position through the continued introduction of new innovations, including preparation for new variants of concern and potentially improving the durability of protection.

Merck & Co., Inc is a leading global drugmaker, producing a wide range of prescription drugs and vaccines in many therapeutic areas in the U.S. and abroad. In Quarter 2, 2022, the company generated total revenues of $14.6 billion, an increase of 28% as compared to the second quarter of 2021, with a total revenue of $11.4. Excluding LAGEVRIO (oral Covid treatment), the business delivered very strong growth of 18%. Both Gardasil (HPV treatment) and Keytruda (for cancer immunotherapy), generated sizable year over year revenue growth in the first quarter of 2022. The company boasts more than six blockbuster drugs in its portfolio, with the PD-L1 inhibitor, Keytruda, approved for several types of cancer, alone accounting for around 40% of its pharmaceutical sales. Keytruda also has phase 3 clinical trials for a different type of cancers that are expected to drive robust growth for several years. It is foreseen that Merck will benefit in the short term from continued demand for Covid-19 related products, while long term prospects will be aided by MRK’s strong and diverse product pipeline.

Viatris Inc is a new global health care company, launched from the combination of Mylan N.V. and Pfizer’s off-patent brand drug business, Upjohn, producing generics and biosimilars. Following the Viatris’ launch, the company’s portfolio has shifted to biosimilars and complex generics, where solid growth opportunities is expected going forward globally. The creation of Viatris is deemed to be positive for long-term revenue and earnings growth considering that the firm is now larger in scale and set to achieve considerable cost synergies. Viatris delivered strong results for Quarter 2, 2022, highlighted by strong performance across the entire business and substantial cash flow generation. The firm generated approximately $84 million in new product revenues in the second quarter of 2022 and new product development is expected to generate $0.6 billion in revenue in 2022, accounting for about 4% of total revenue. The firm’s CEO, Michael Goettler, stated that they will continue to leverage their scientific and R&D capabilities to ensure that patients have access to safe, effective, and high-quality medicines.

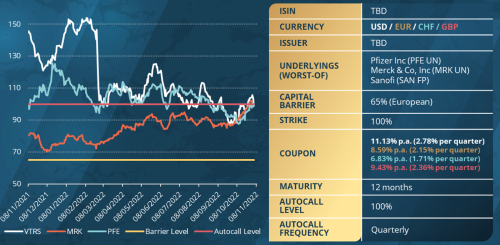

BRC Autocallable | Product Snapshot

For informational purpose only - No investment advice

By the Mauritius Team

Insights

November 7, 2022

Looking for the cure!

The Pharmaceuticals industry is the second-largest industry (in terms of total revenue) in the global Health Care sector. The industry has experienced rapid expansion in recent years, and the outlook continues to be positive for 2023. The industry is expected to exceed $1 trillion by 2023. This is mainly because there are thousands of compounds that are currently in the last phases of clinical development, along with hundreds of new drugs whose approvals are expected in 2023 and later. The pharmaceutical sector has played a crucial role during the pandemic and seems likely to continue beyond 2023. We have seen in recent times about the importance of the pharmaceutical companies as well as the cash they generated. This has definitely bolstered their reputations. Going forward, we use 3 stocks that analysts believe to have a strong perspective outlook: Pfizer Inc, Merck & Co., Inc and Viatris Inc.

Pfizer Inc is one of the world's largest pharmaceutical companies, with extensive operations in drug development, manufacturing, and marketing. Pfizer’s largest market is the U.S., accounting for 37% of 2021 sales, followed by emerging markets at 25%, developed Europe at 23%, and developed Rest of the World at 15%. Pfizer is believed to be among the most diversified drug portfolio in the global drug market. Recently, Pfizer Inc reported strong financial results for second quarter of 2022, with a revenue of $27.7 billion, an increase of 47% as compared to the second quarter of 2021. The company was able to grow its revenue by an outstanding 53% year over year. The quarterly revenue figure represented the largest in Pfizer's history. With the proceeds from the vaccine, the firm is making strategic acquisitions. It has been noted that the $2.26B acquisition of Trillium Therapeutics, a clinical stage immuno-oncology firm developing innovative cancer therapies serving the fast-growing oncology market, as positive. The firm expects to further enhance its position through the continued introduction of new innovations, including preparation for new variants of concern and potentially improving the durability of protection.

Merck & Co., Inc is a leading global drugmaker, producing a wide range of prescription drugs and vaccines in many therapeutic areas in the U.S. and abroad. In Quarter 2, 2022, the company generated total revenues of $14.6 billion, an increase of 28% as compared to the second quarter of 2021, with a total revenue of $11.4. Excluding LAGEVRIO (oral Covid treatment), the business delivered very strong growth of 18%. Both Gardasil (HPV treatment) and Keytruda (for cancer immunotherapy), generated sizable year over year revenue growth in the first quarter of 2022. The company boasts more than six blockbuster drugs in its portfolio, with the PD-L1 inhibitor, Keytruda, approved for several types of cancer, alone accounting for around 40% of its pharmaceutical sales. Keytruda also has phase 3 clinical trials for a different type of cancers that are expected to drive robust growth for several years. It is foreseen that Merck will benefit in the short term from continued demand for Covid-19 related products, while long term prospects will be aided by MRK’s strong and diverse product pipeline.

Viatris Inc is a new global health care company, launched from the combination of Mylan N.V. and Pfizer’s off-patent brand drug business, Upjohn, producing generics and biosimilars. Following the Viatris’ launch, the company’s portfolio has shifted to biosimilars and complex generics, where solid growth opportunities is expected going forward globally. The creation of Viatris is deemed to be positive for long-term revenue and earnings growth considering that the firm is now larger in scale and set to achieve considerable cost synergies. Viatris delivered strong results for Quarter 2, 2022, highlighted by strong performance across the entire business and substantial cash flow generation. The firm generated approximately $84 million in new product revenues in the second quarter of 2022 and new product development is expected to generate $0.6 billion in revenue in 2022, accounting for about 4% of total revenue. The firm’s CEO, Michael Goettler, stated that they will continue to leverage their scientific and R&D capabilities to ensure that patients have access to safe, effective, and high-quality medicines.

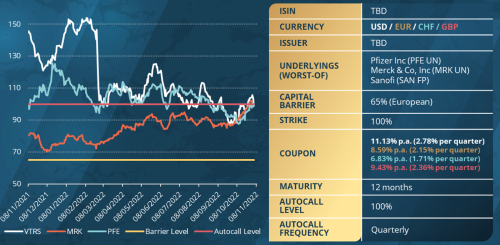

BRC Autocallable | Product Snapshot

For informational purpose only - No investment advice

By the Mauritius Team