Actualités

Expertises

Expertises

Expertises

18 juillet 2025

Le retour offensif de l’OPEP+ sur le marché pétrolier

Expertises

04 juillet 2025

Cap sur La Prochaine Vague du E-commerce

Expertises

25 juin 2025

Quand les déchets deviennent une opportunité

1

2

3

Expertises

24 février 2025

TRUMP'S INFRASTRUCTURE SHIFT: FOCUS ON ROADS, BRIDGES, AND PRIVATE INVESTMENT

Donald Trump`s White house press secretary, Karoline Leavitt has announced on 21 January that a “massive” infrastructure plan was in due course. This initiative comes in response to the growing demand for updated roads, bridges, and urban development, as the infrastructure in the United States has been ageing and deteriorating. With Trump back in office, there is expected to be "a greater focus on more traditional infrastructure like roads and bridges," according to Alex Etchen, vice president of government relations at the Associated General Contractors of America.

It’s clear there are differences in infrastructure priorities between the new Trump and Biden administrations. Trump has issued an executive order halting the disbursement of funds from the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA). This action has placed numerous public works and clean energy construction projects in uncertainty, affecting initiatives across multiple states. On the other hand, expected investment in new data center constructions, the energy sector, roads and bridges may benefit traditional construction companies.

The demand for new construction remains high, with urban expansion and commercial development requiring significant resources and investment in transport networks. As a result, increased investment in infrastructure is expected, driving the need for additional materials, skilled labor, and increased production of construction equipment. Additionally, boosting domestic manufacturing of building materials is necessary to meet growing demand. With federally funded projects stalled and private construction demand rising, traditional construction firms are expected to benefit in the short run.

RESILIENT PROFITS AMID ATTRACTIVE VALUATIONS

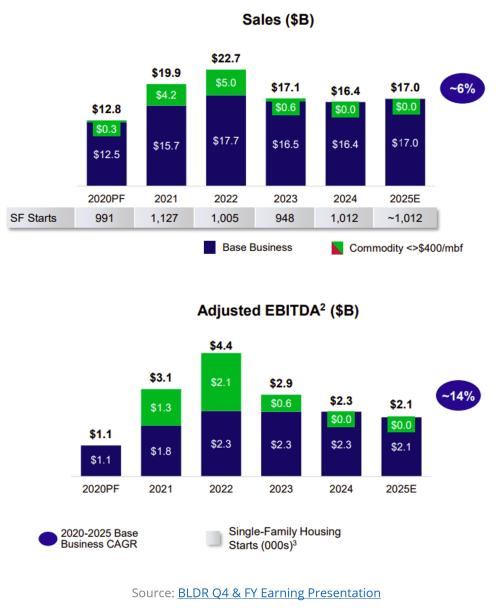

Builders FirstSource (BLDR UN) continues to demonstrate solid financial performance, with operating profits showing steady growth despite market fluctuations. As of Q3 2024, the company maintains a strong gross profit of $1.4 billion and an asset base of $10.89 billion, while share prices remain at approximately 3.93 times its book value. With increasing demand for construction materials and infrastructure investment, BLDR has sustained profitability, even as macroeconomic concerns weigh on valuation metrics. Investors remain cautious due to potential headwinds in material costs and supply chain constraints, but the company’s strong fundamentals and resilient earnings continue to support long-term growth prospects.

HISTORICAL UNDERPERFORMANCE

Builders FirstSource (BLDR) has experienced strong financial growth in recent years, driven by increased demand in the construction sector. Despite its solid fundamentals, BLDR’s stock valuation remains below broader market levels, reflecting investor caution amid potential economic slowdowns and supply chain challenges.

BLDR is currently trading at a price-to-earnings (P/E) ratio below industry averages, signaling a conservative market outlook despite consistent profitability. Comparatively, the company maintains a robust balance sheet with strong cash flow generation, ensuring financial stability even during market downturns.

INVESTMENT CASE

Builders FirstSource has demonstrated resilience in the construction materials sector, benefiting from sustained demand for building supplies despite macroeconomic challenges. While interest rate hikes have affected housing affordability, they have also supported profitability for key industry players, as higher borrowing costs have yet to significantly slow down construction activity.

BLDR continues to report strong financial performance - the numbers show a small decrease on EBITDA with improving margins and stable demand for its products. However, investor sentiment remains cautious, with concerns over potential slowdowns in residential construction and supply chain constraints weighing on the stock's valuation. The company currently trades at relatively low price-to-earnings and price-to-book ratios, reflecting market concerns despite its solid operational performance.

A structured investment approach in BLDR could provide exposure to the company's long-term growth while mitigating downside risks. A well-designed financial product could offer great opportunities while allowing investors to benefit from potential price appreciation. If BLDR's stock reaches a predetermined upside barrier during the investment period, returns could be capped at an attractive level while ensuring downside protection.

Product Snapshot

For informational purposes only. Not investment advice.

Expertises

24 février 2025

Trump's Infrastructure

TRUMP'S INFRASTRUCTURE SHIFT: FOCUS ON ROADS, BRIDGES, AND PRIVATE INVESTMENT

Donald Trump`s White house press secretary, Karoline Leavitt has announced on 21 January that a “massive” infrastructure plan was in due course. This initiative comes in response to the growing demand for updated roads, bridges, and urban development, as the infrastructure in the United States has been ageing and deteriorating. With Trump back in office, there is expected to be "a greater focus on more traditional infrastructure like roads and bridges," according to Alex Etchen, vice president of government relations at the Associated General Contractors of America.

It’s clear there are differences in infrastructure priorities between the new Trump and Biden administrations. Trump has issued an executive order halting the disbursement of funds from the Infrastructure Investment and Jobs Act (IIJA) and the Inflation Reduction Act (IRA). This action has placed numerous public works and clean energy construction projects in uncertainty, affecting initiatives across multiple states. On the other hand, expected investment in new data center constructions, the energy sector, roads and bridges may benefit traditional construction companies.

The demand for new construction remains high, with urban expansion and commercial development requiring significant resources and investment in transport networks. As a result, increased investment in infrastructure is expected, driving the need for additional materials, skilled labor, and increased production of construction equipment. Additionally, boosting domestic manufacturing of building materials is necessary to meet growing demand. With federally funded projects stalled and private construction demand rising, traditional construction firms are expected to benefit in the short run.

RESILIENT PROFITS AMID ATTRACTIVE VALUATIONS

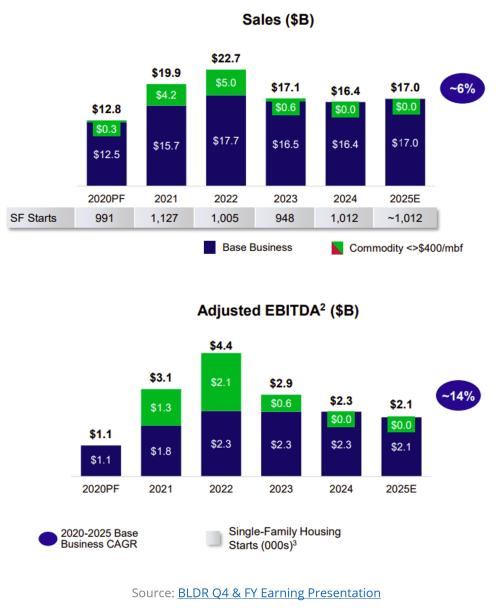

Builders FirstSource (BLDR UN) continues to demonstrate solid financial performance, with operating profits showing steady growth despite market fluctuations. As of Q3 2024, the company maintains a strong gross profit of $1.4 billion and an asset base of $10.89 billion, while share prices remain at approximately 3.93 times its book value. With increasing demand for construction materials and infrastructure investment, BLDR has sustained profitability, even as macroeconomic concerns weigh on valuation metrics. Investors remain cautious due to potential headwinds in material costs and supply chain constraints, but the company’s strong fundamentals and resilient earnings continue to support long-term growth prospects.

HISTORICAL UNDERPERFORMANCE

Builders FirstSource (BLDR) has experienced strong financial growth in recent years, driven by increased demand in the construction sector. Despite its solid fundamentals, BLDR’s stock valuation remains below broader market levels, reflecting investor caution amid potential economic slowdowns and supply chain challenges.

BLDR is currently trading at a price-to-earnings (P/E) ratio below industry averages, signaling a conservative market outlook despite consistent profitability. Comparatively, the company maintains a robust balance sheet with strong cash flow generation, ensuring financial stability even during market downturns.

INVESTMENT CASE

Builders FirstSource has demonstrated resilience in the construction materials sector, benefiting from sustained demand for building supplies despite macroeconomic challenges. While interest rate hikes have affected housing affordability, they have also supported profitability for key industry players, as higher borrowing costs have yet to significantly slow down construction activity.

BLDR continues to report strong financial performance - the numbers show a small decrease on EBITDA with improving margins and stable demand for its products. However, investor sentiment remains cautious, with concerns over potential slowdowns in residential construction and supply chain constraints weighing on the stock's valuation. The company currently trades at relatively low price-to-earnings and price-to-book ratios, reflecting market concerns despite its solid operational performance.

A structured investment approach in BLDR could provide exposure to the company's long-term growth while mitigating downside risks. A well-designed financial product could offer great opportunities while allowing investors to benefit from potential price appreciation. If BLDR's stock reaches a predetermined upside barrier during the investment period, returns could be capped at an attractive level while ensuring downside protection.

Product Snapshot

For informational purposes only. Not investment advice.